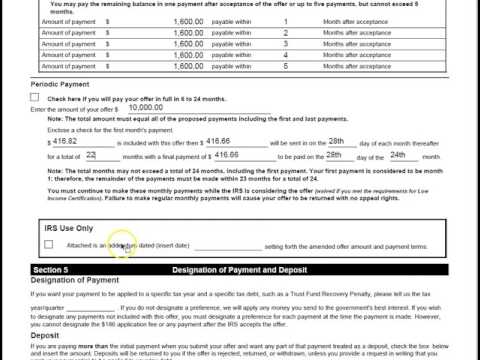

This is a man that Kindle it to resolve tax professionals. I want to show you how to fill out a form 656 which is the offer and compromise application if you want to submit an offer and compromise with the Internal Revenue Service. This form is going to start off by asking you if you have used the pre-qualifier tool located on the IRS website right here you can check yes or no depending on whether you did that pre-qualifier tool. Is a fairly good calculator if you want to see if you qualify for an offer and compromise however I have seen it do some incorrect calculations on those incorrect calculations are usually just based on the taxpayer not knowing how to properly answer the questions to get a correct answer out of the PRE qualifier tool. You will see here that the offering compromise does require one hundred and eighty-six dollar application fee and in an initial payment with two six fifty-six. That you must complete a form 433 a or a 433 be oh I see form these are separate from the 433 a and the 433 B forms that I have done previously they also require some supporting documentation with this form if you have any questions on what supporting documentation it is explained towards the end of this application and on the 433 an oh I see. However, you can always call my office at seven two zero three one nine eight nine five four if you have any questions on how to fill the salary you need some help with it section one is going to be our individual information for individual taxpayers form 1040 filers, so we're going to put in your first name and last name here I'm just using my...

Award-winning PDF software

How to prepare Form 656-B

About Form 656-B

Form 656-B is a document used by the Internal Revenue Service (IRS) in the United States. It is known as the Collection Information Statement for Businesses and is required by businesses that owe back taxes to the IRS. The form provides the IRS with information about the business' finances, including bank accounts, monthly income, and expenses, and other assets. The IRS uses this information to determine the taxpayer's ability to pay back taxes owed and to set up a payment plan or offer in compromise. The form is typically used in situations where the business owes more than $50,000 in taxes or if the business is seeking an installment plan of more than 24 months. It is important to provide accurate and complete information on the form, as any errors or omissions could result in delays or rejection of the application.

What Is 656?

Online solutions make it easier to organize your file management and improve the efficiency of the workflow. Observe the short manual in an effort to fill out Irs 656, avoid mistakes and furnish it in a timely manner:

How to fill out a Form 656 B?

-

On the website hosting the form, choose Start Now and pass towards the editor.

-

Use the clues to complete the appropriate fields.

-

Include your individual information and contact details.

-

Make absolutely sure that you enter accurate information and numbers in suitable fields.

-

Carefully revise the information of the form as well as grammar and spelling.

-

Refer to Help section when you have any concerns or contact our Support staff.

-

Put an electronic signature on your 656 printable while using the help of Sign Tool.

-

Once blank is finished, press Done.

-

Distribute the prepared document by using electronic mail or fax, print it out or save on your gadget.

PDF editor allows you to make alterations on your 656 Fill Online from any internet connected device, customize it in accordance with your requirements, sign it electronically and distribute in different approaches.

What people say about us

Filing digitally templates from your home - important suggestions

Video instructions and help with filling out and completing Form 656-B